Generics vs Brand-Name Drugs: What Your Insurance Actually Covers

When you pick up a prescription, you might be handed a small white pill in a plain bottle - or a larger, colorful one with a well-known brand name. Both treat the same condition. Both have the same active ingredient. But one costs $4. The other costs $85. Why? It’s not about effectiveness. It’s about insurance formulary rules.

How Insurance Decides What You Pay

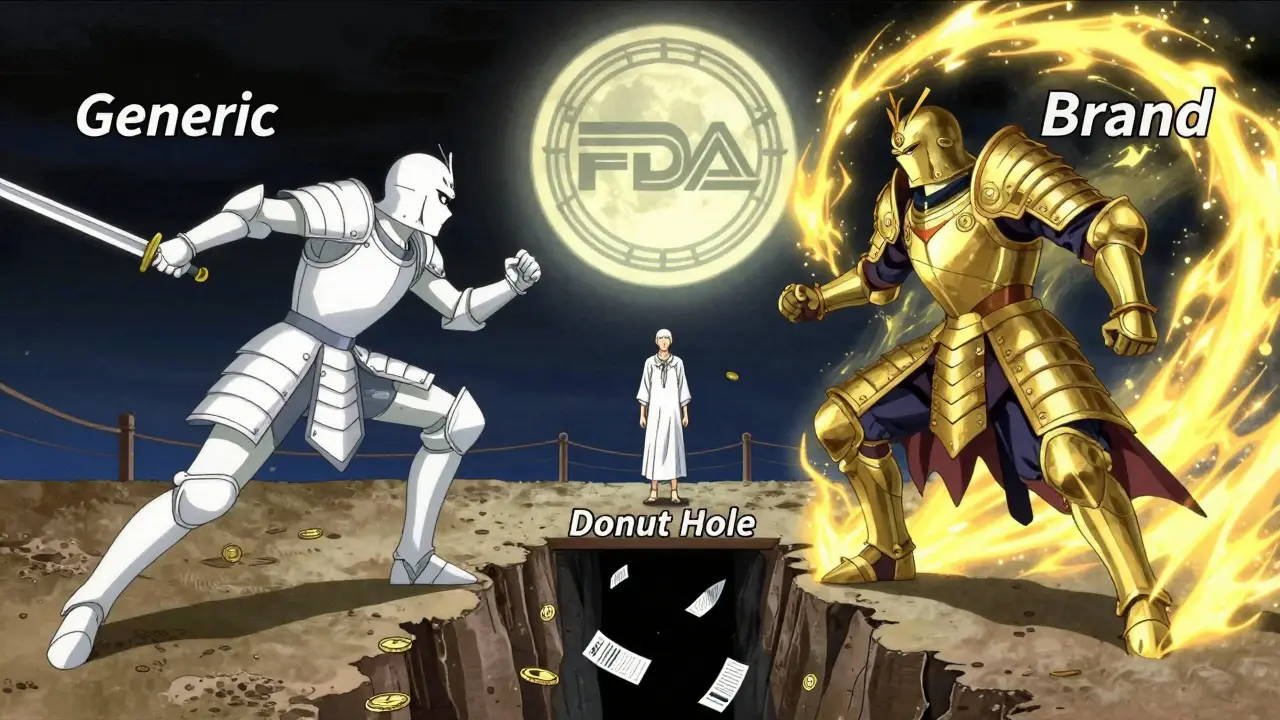

Insurance companies don’t just cover drugs randomly. They organize them into tiers, like levels in a game. Tier 1 is the cheapest. Tier 4 is the most expensive. Generics almost always land in Tier 1. Brand-name drugs? They’re stuck in Tier 2 or 3 - sometimes even Tier 4.That means if you’re on a typical commercial plan, your copay for a generic might be $5 to $15 for a 30-day supply. For the brand-name version? You’re looking at $40 to $100. Even worse: if a generic exists and you still want the brand, your insurer might make you pay the generic copay plus the full price difference. So if the brand costs $85 and the generic is $4, you pay $15 (the generic copay) + $81 (the difference) = $96. That’s not a mistake. That’s policy.

This system isn’t arbitrary. It’s built to save money. In 2022, 90% of all prescriptions filled in the U.S. were generics. That saved the system $370 billion in one year alone. Insurance companies push generics because they work - and they’re cheaper to produce. No clinical trials. No marketing campaigns. Just the same active ingredient, packaged differently.

The Legal Backing: Hatch-Waxman and Beyond

The whole system started with the Hatch-Waxman Act of 1984. Before that, generic drugs were hard to get approved. The law changed that. It let generic makers prove their drugs were just as safe and effective as the brand - without repeating expensive clinical trials. In return, brand-name companies got extra patent protection to make up for lost time during FDA review.Today, the FDA requires generics to match brand-name drugs in strength, dosage, safety, and effectiveness. That’s not a suggestion. It’s the law. The FDA says: “Any generic medicine must perform the same in the body as the brand-name medicine.” So why the price gap? Because the brand paid for the original research. The generic didn’t.

But here’s the twist: not all generics are created equal. Some are made by the same company that makes the brand. These are called “authorized generics.” They’re identical to the brand, just sold under a different label. And guess what? Insurance often covers them better than third-party generics because they’re seen as more reliable.

When You Can’t Get the Generic

You might think: “If it’s the same, why would anyone need the brand?” The answer? Sometimes, it’s not about the active ingredient. It’s about the fillers - the inactive stuff that holds the pill together. For most people, it doesn’t matter. But for some, those fillers cause side effects.Patients with thyroid disease, epilepsy, or depression often report issues after switching from brand to generic. A 2022 study in JAMA Neurology found that 12.3% more seizures occurred in epilepsy patients after switching to generic levetiracetam. That’s not a huge number - but for the person who had a seizure because of the switch, it’s everything.

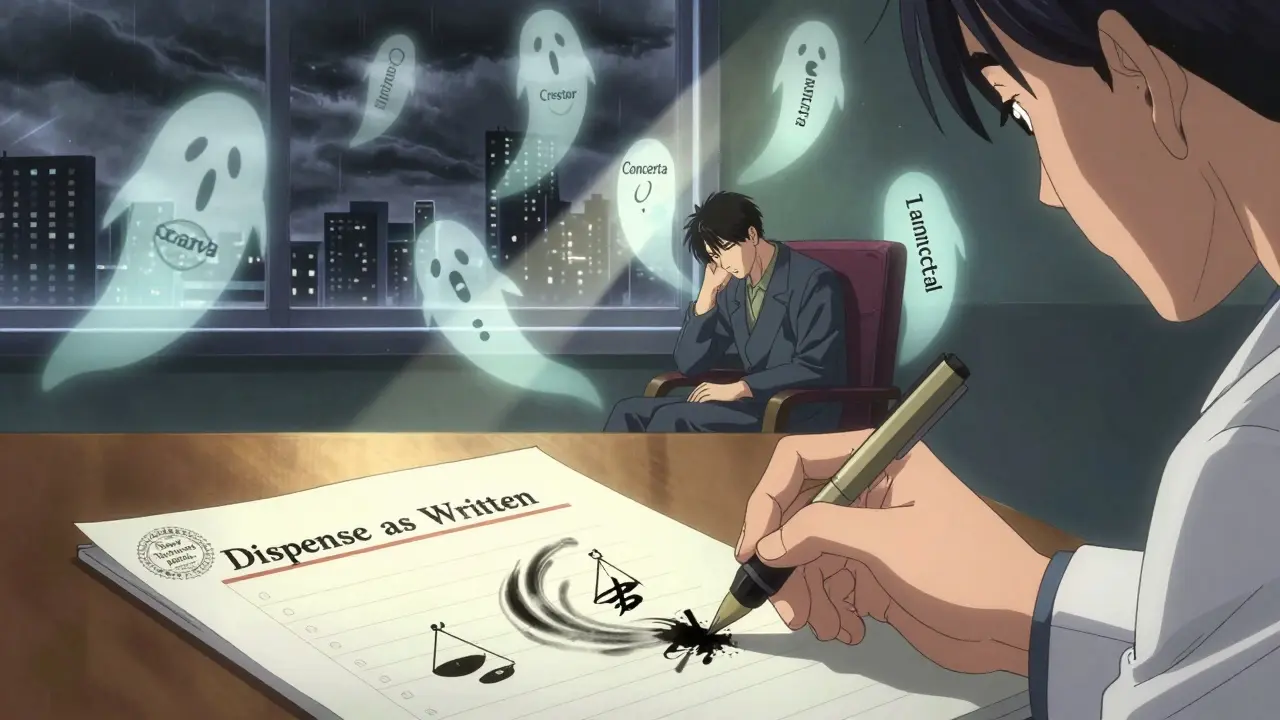

That’s why doctors can write “dispense as written” or “do not substitute” on a prescription. In 42 states, that’s enough to override the insurance’s generic-first rule. In 8 states, it’s harder. Some require proof that two or three generics failed first. That means you might wait six to eight weeks before getting the brand you need.

For drugs with a narrow therapeutic index - like warfarin, phenytoin, or levothyroxine - 27 states have special rules. These drugs have a tiny window between “effective” and “toxic.” Even small differences in absorption can be dangerous. So insurers often cover the brand without extra paperwork.

How Medicare and Medicaid Handle It

Medicare Part D plans are even stricter. By law, pharmacists must substitute generics unless the doctor says no. In 2022, 91% of all Medicare Part D prescriptions were generics. That’s good for the system. But bad if you’re the one who can’t tolerate the switch.Medicaid is different. It pays the lowest price available - the “best price.” That means generics cost Medicaid 87% less than brand-name drugs. So they push generics hard. But Medicaid patients can’t use manufacturer copay cards. Those are banned for government programs. So if you’re on Medicaid and the generic makes you sick, you’re stuck - unless your doctor fights for an exception.

And then there’s the “donut hole.” In Medicare Part D, once you hit a certain spending limit, you pay 25% of the drug cost - whether it’s generic or brand. But here’s the catch: the brand-name drug’s full price counts toward getting you out of the gap. The generic’s lower price? It doesn’t help as much. So if you need a brand, you might get out of the donut hole faster - even if you’re paying more upfront.

What Patients Actually Experience

On Reddit, a thread titled “I paid $85 for Crestor instead of $4 generics” had over 1,200 upvotes. People shared stories of being denied coverage for brand-name drugs even when generics caused anxiety, insomnia, or worse. On Drugs.com, a thread about generic switches causing problems has over 2,800 comments - mostly from people who switched from brand-name Concerta, Wellbutrin XL, or Lamictal and felt like their medication stopped working.A Kaiser Family Foundation survey found that 34% of insured patients didn’t understand when their plan would cover a brand-name drug. And 19% skipped filling prescriptions because they were afraid of the cost. That’s not just confusion. That’s a system that’s hard to navigate.

And yet, 78% of people who use generics say they’re happy with the savings. The problem isn’t the generic itself. It’s the lack of clear rules and flexibility when things go wrong.

What You Can Do

If you’re on a plan that forces you to use a generic and you feel worse:- Ask your doctor to write “dispense as written” on the prescription.

- Request a prior authorization. This is a formal appeal. It takes 2-3 business days on average, but sometimes longer.

- Check if your drug is on the “narrow therapeutic index” list - if so, you may qualify for automatic brand coverage.

- Call your insurer’s pharmacy help line. Ask: “What’s the exact reason my brand-name drug was denied?” They’re required to tell you.

- Use GoodRx or SingleCare to compare cash prices. Sometimes, paying out-of-pocket for the brand is cheaper than your copay after the insurer adds the difference.

If you’re on Medicare, you can use the Plan Finder tool to see which drugs are covered and at what tier. And if you’re switching plans during open enrollment, check the formulary - not just the premium. A cheap plan with bad drug coverage can cost you more in the long run.

The Bigger Picture

The push for generics isn’t just about saving money. It’s about making healthcare sustainable. Without generics, many people couldn’t afford their meds at all. But rigid rules don’t always serve patients. The system works best when it’s flexible - when doctors can override it for medical reasons, and when patients aren’t punished for needing a brand.Some states are starting to change. California’s SB 1055 (2022) says insurers must cover a brand-name drug if a generic causes side effects. Texas limits brand coverage to cases where no generic exists. The federal government is also stepping in. The Inflation Reduction Act capped insulin at $35 a month - and starting in 2025, the FDA will require clearer labeling on generics to show how closely they match the brand.

For now, the system favors generics. And for most people, that’s fine. But if you’re one of the ones who doesn’t respond the same way - you’re not imagining it. You’re not being difficult. You’re just part of the 10% who need more than a one-size-fits-all rule.

Are generic drugs really the same as brand-name drugs?

Yes, by FDA standards. Generics must contain the same active ingredient, strength, dosage form, and route of administration as the brand. They must also meet the same strict manufacturing and safety standards. The FDA says they are therapeutically equivalent. But some patients report differences in side effects or effectiveness - often due to inactive ingredients like fillers or dyes, which aren’t regulated as tightly.

Why do insurance companies prefer generics?

Because they cost 80%-85% less. Generics don’t require expensive clinical trials or marketing campaigns. Insurance companies use tiered formularies to encourage patients to choose cheaper options, which lowers overall drug spending. In 2022, generics saved the U.S. healthcare system $370 billion.

Can I be forced to switch from a brand to a generic?

Yes, unless your doctor writes “dispense as written” or “do not substitute” on the prescription. Pharmacists are legally allowed to substitute generics in all 50 states. Some insurers automatically switch you unless you opt out. If you feel worse after switching, you can appeal through a prior authorization request.

What if the generic doesn’t work for me?

You can ask your doctor to file a prior authorization for the brand-name drug. Many insurers require proof that you tried two or three generics first - especially for chronic conditions like depression or epilepsy. For drugs with a narrow therapeutic index (like warfarin or levothyroxine), coverage is often automatic. Check your state’s rules - some, like California, require insurers to cover the brand if the generic causes side effects.

Do Medicare and Medicaid cover brand-name drugs?

Yes - but only under specific conditions. Medicare Part D requires pharmacists to substitute generics unless the doctor says no. Medicaid pays the lowest available price, so it heavily favors generics. However, both programs allow brand-name coverage if medical necessity is documented. Medicare beneficiaries can’t use manufacturer copay cards, but Medicaid patients can sometimes get help through state programs.

Are there any drugs where generics aren’t allowed?

No drug is legally banned from having a generic. But some - like complex injectables, inhalers, and biologics - don’t have true generics yet. Instead, they have biosimilars, which are similar but not identical. Insurance coverage for these is often more flexible. Also, 27 states have special rules for narrow therapeutic index drugs (like levothyroxine and phenytoin) where brand-name coverage is easier to get.

What Comes Next

The future of drug coverage is changing. As more brand-name drugs lose patent protection, insurers are tightening rules even more - requiring prior authorization for newly generic drugs at a rate that jumped from 38% in 2018 to 67% in 2023. At the same time, new complex drugs - like injectables and inhalers - are harder to copy. That means insurance policies will need to evolve beyond simple generic-vs-brand decisions.For now, the key is knowing your rights. Understand your formulary. Ask questions. Don’t assume a generic is always better - or always worse. And if you’re struggling, you’re not alone. Millions of people are navigating the same system. The goal isn’t to eliminate generics. It’s to make sure they work for everyone - not just the majority.

Michael Dillon

December 26, 2025 AT 10:01Generics are 90% of prescriptions for a reason. I used to be one of those people who swore brand-name was better until I switched to generic levothyroxine and didn’t notice a difference. The system works. Stop pretending your body is special.

Ben Harris

December 26, 2025 AT 14:41So you’re telling me the same pill with different dyes and fillers is magically identical? I’ve had panic attacks switching from brand to generic Wellbutrin. And now they want to make me pay $96 for the privilege of being medicated properly? This isn’t healthcare it’s corporate torture

Gary Hartung

December 27, 2025 AT 22:04Let’s be clear: the Hatch-Waxman Act was never meant to be weaponized into a profit-driven, patient-disregarding machine. The FDA’s equivalence standards are technically sound-but they ignore bioavailability variance in real-world physiology. The 12.3% seizure increase in levetiracetam generics? That’s not anecdotal. That’s a statistical red flag masked as regulatory compliance.

Jason Jasper

December 28, 2025 AT 01:03I’ve been on generic warfarin for five years. No issues. My uncle switched from brand to generic Lamictal and had a seizure. We’re not talking about one size fits all. The system needs flexibility-not rigid rules. Doctors should have more say.

Linda B.

December 29, 2025 AT 16:38They’re not just saving money they’re controlling you. The pharmaceutical-industrial complex is using insurance as a puppet. The FDA? Complicit. The ‘authorized generics’? Same factory same pill different label. They want you to think you’re getting a deal when you’re just being manipulated

Mussin Machhour

December 30, 2025 AT 16:07GoodRx saved me $70 on my brand-name ADHD med last month. I paid cash and felt like a genius. Insurance bureaucracy is a nightmare but there are workarounds. Don’t give up. Ask. Research. Fight back.

Christopher King

January 1, 2026 AT 09:10This entire system is a simulation. The pills are the same. The prices are arbitrary. The formularies? A game designed to make you feel powerless. The real drug isn’t in the bottle-it’s the illusion of choice. You think you’re selecting treatment. You’re just choosing which cage to sit in.

Bailey Adkison

January 2, 2026 AT 05:00People complain about generics but ignore that 90% of prescriptions are generics because they work. If your body reacts to fillers you have a rare sensitivity. That doesn’t invalidate the system. It means you need a doctor’s note. Simple.

Rick Kimberly

January 3, 2026 AT 01:48Is there any peer-reviewed data comparing bioequivalence variance across generic manufacturers? I’m curious whether the source of the generic-whether domestic or overseas-affects clinical outcomes beyond the placebo effect. The FDA’s equivalence standards are robust but the supply chain is not transparent.

Terry Free

January 3, 2026 AT 18:32Insurers are playing chess with your health. Generic = Tier 1. Brand = Tier 4. Difference = you pay the gap. That’s not policy. That’s predatory pricing disguised as cost containment. They know you won’t fight. They’re counting on it.

Sophie Stallkind

January 4, 2026 AT 05:28It is imperative to acknowledge that the structural inequities embedded within pharmaceutical formularies disproportionately impact low-income populations. Medicaid beneficiaries are particularly vulnerable, as they are precluded from utilizing manufacturer copay assistance programs. This constitutes a systemic failure in equitable access to therapeutic alternatives.

Katherine Blumhardt

January 4, 2026 AT 23:40my dr said i cant switch from brand to generic for my anxiety med but my ins said no so i had to call 5 times and now im on a 6 week wait for an exception. this is so f***ing stupid. i just want to not cry all day

sagar patel

January 5, 2026 AT 12:05India makes 40% of the world’s generics. If you’re on a generic you’re probably taking medicine made by a factory with less regulation than your local bakery. This isn’t science. It’s global outsourcing with a side of placebo.

Oluwatosin Ayodele

January 6, 2026 AT 13:38Everyone here is acting like this is new. In Nigeria we don’t even have brand-name drugs. We get generics. Sometimes they work. Sometimes they don’t. But we don’t have the luxury of complaining. You think this is bad? Try paying $200 for a 30-day supply of insulin with no insurance. Then come back and tell me about formularies.